I recently had a terrible experience with Wise (formerly Transferwise) arbitrarily suspending my account that turned me from an evangelist to a detractor in the course of a few painful weeks.

The tl;dr version is that a service is only as good as how it handles failure. When services platforms structure themselves as products and focus on growth through bolting on new features as fast as possible, it racks up organisational and structural debt that eventually ruins the service.

A key difference between service thinking and product thinking is that functions such as customer support, communications, verification are the service, not ancillary support functions of a product.

The long version is a useful case study in how mismatched touch points aggregate to a service failure.

Expectation Setting

The first mismatch of expectation is that Wise is not a real bank. Depending on the territory, it’s a payment institution or a licensed money transmitter. This is true of many fintech companies who innovate in the grey areas between regulations. Sometimes this is a good thing. It forces the incumbent players to up their game and Wise rightly saw that currency transfers are a rip-off ripe for disruption.

Wise’s non-bank status was never a problem while they focused on doing one thing well: cheaper and more transparent currency transfers. It started to become a problem as Wise added features—cards, interest, business accounts, etc.—that made accounts look and feel like a traditional bank account. This was also the rationale behind their re-brand from Transferwise to Wise.

This sleight of hand is crucial to them nibbling away at traditional banks’ domains, but it also sets up the expectation that it should behave and be regulated like a real bank.

Computer Says No

For me the problem started when I was asked to verify my “source of wealth“ (I‘ve been looking for that, too. What they mean is “income” – using jargon is not a great start). A big pink banner at the top of my online banking and that took up half the screen space in the app informed me of this requirement and the 30-day deadline or face account suspension.

Strange, I thought, since I verified with Wise years ago and have used it without problem ever since. Additionally, my coaching clients, who are all over the world, pay directly into my Wise account. That is my “source of wealth” and they have all the data they should need.

Nevertheless, I tried to comply. I attempted to connect my real bank account using Wise’s open banking (I think?) service, which kept hanging without error messages. It wasn’t until I issued a GDPR Subject Access Request for my data from Wise that I found out it had actually worked.

Again the pink banner and e-mails with the same vagaries about “as a regulated financial institution…” and a list of documents they would accept, among them bank statements. So I uploaded my bank statements. The upload system failed several times too and I also felt uncomfortable with this. They’re not the tax office, after all, and don’t really have the right to know all of my financial transactions, plus they had already demonstrated their operational flakiness.

The threatening pink banner persisted. The clock was ticking towards my account suspension.

Untrained, overwhelmed support + bots

I contacted their support on Twitter who were both slow and unhelpful, parroting the same requests and unable to tell me why they needed this information. I simply wanted to know from a human what, exactly, was wrong with the information I had submitted.

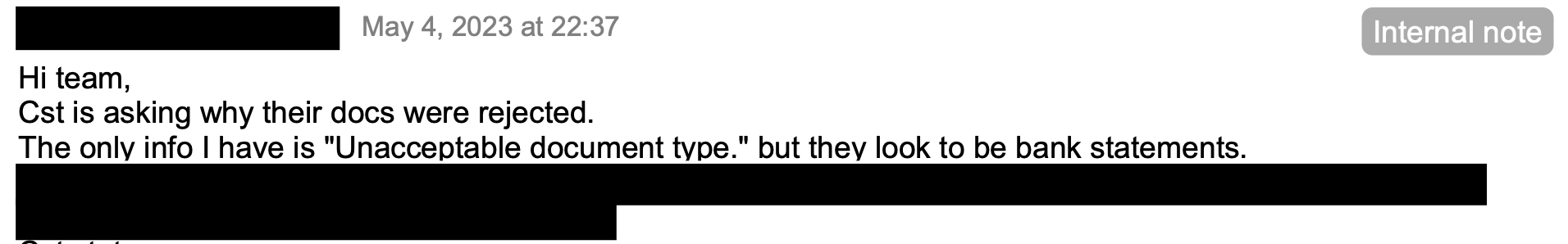

The Twitter and e-mail support also kept re-triggering automated triage bots. Once I obtained copies of my customer data, it was clear these triggered the creation of new support tickets rather than continuing the same one. Most of the time I received “this has been escalated, we are working on it“ responses and then radio silence.

It turned out Wise wanted my payslips, proof of payment from a “freelancing platform” (not sure what that means) or my most recent tax returns. I’m self-employed, so none of the first two were available and my most recent tax return is still being processed by the tax office. I explained many times that I could not provide a document that did not yet exist and nobody could tell me why they suddenly wanted this. The support tickets shows helpless staff struggling with what the system was spitting out.

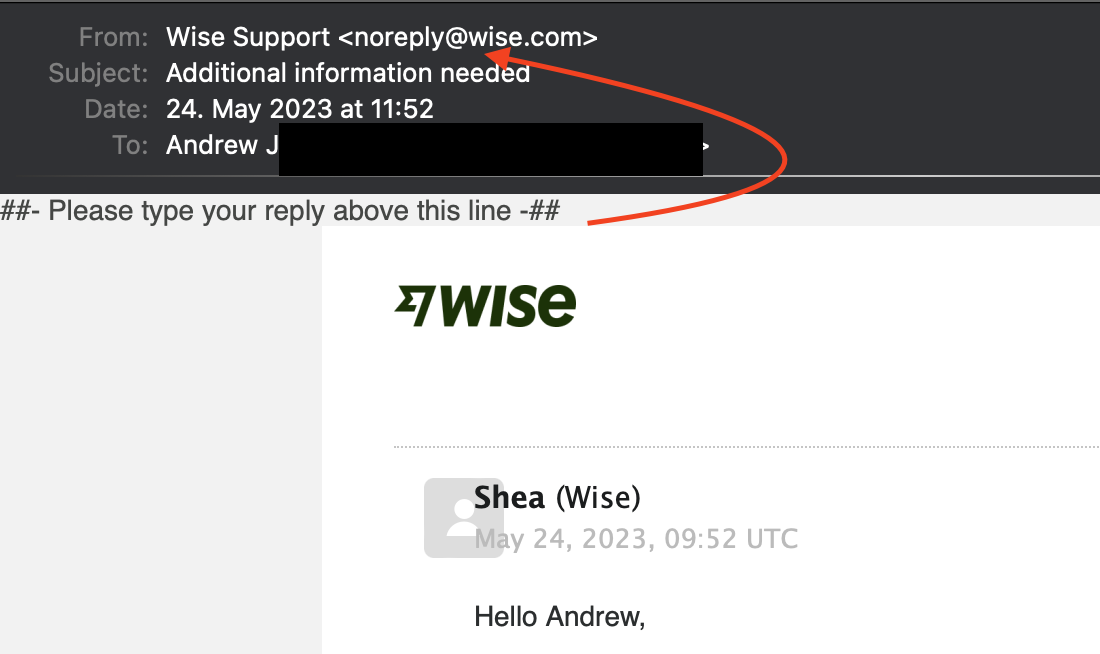

At one point I received an email from a noreply@wise.com address, yet this had instructions to “reply above the line”. Were my replies going somewhere or not? Should I reply or not? 🤷

Pink banner. More days go by. Each time I was told it would take 2-5 days to respond, but their deadline did not change.

I finally called the UK number and the agent provided me with the same computer says no response. When I asked about how to make a complaint, he told me this would take several weeks — did I really want to do that instead of handling it through support? The threat here was clear—complain and it will take longer to resolve your issue. Could I not do both? Nevertheless a far more innocent note was placed in Zendesk:

I asked this because the How do I make a complaint? page contains a link to the page to make an appeal, but this merely redirects back to the log-in page (or account page if one is already logged in). There is no place on the Account or Log-In page to make an appeal 🤦.

Threat Level

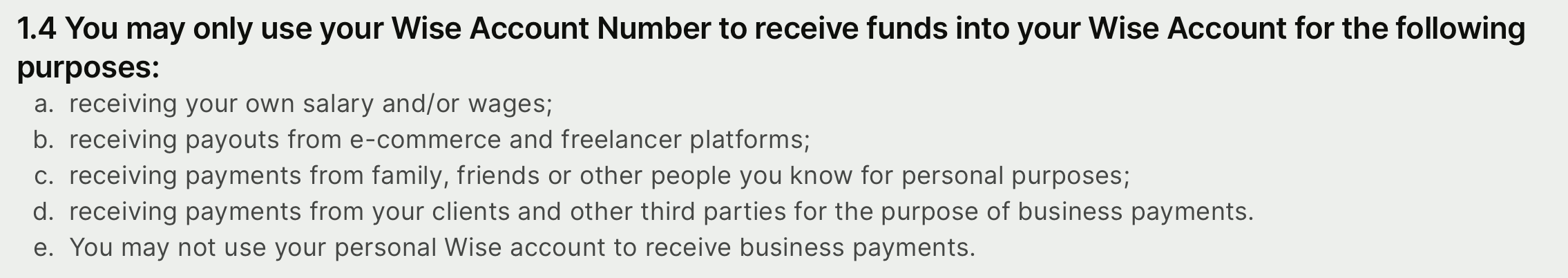

Then the tone changed. I was told that I had contravened Wise’s acceptable use policy by using my personal account to accept client payments. (This policy was quite different when I originally opened my account. Much like Netlfix and iTunes licence agreements, I’ve not read the updates regularly.)

Not only did this feel like retaliation for complaining, but the policy text is contradictory:

It’s entirely unclear to me still what the difference between receiving payments from clients “for the purpose of business payments” and receiving “business payments” is. Wise need to hire a content designer to work with their legal team.

Ultimately the threat of a complaint to the Financial Ombudsman escalated the response to the Complaints Team, but only after my account was suspended, a truly PayPal move. It turns out I’m not the only one who has had this treatment.

Service Ecosystems vs Product Silos

I can hear your sobs of sympathy about my first-world problem, but my story isn’t intended to be “poor me!” It is a case study in how organisations scaling too fast end up with siloed operations. As we said in our book, “services created in silos are experienced in bits.” When you look at the list of small fails, they add up to a picture of backstage incompetence, with poor coordination, too much automation and communications that made things worse.

The biggest problem in disconnected companies like this is that each problem looked at on its own by individual product managers or business owners doesn’t look like a big deal. “Yes, support is a bit slow and not great, but we’re getting there. Yes the automated is a bit clunky, but look at the cost savings.” It’s the systems effect of multiple small fails snowballing into a big one that is the problem, but this won’t be seen from the internal organisational view.

I worry that this is the beginning of the enshitification of Wise. Their mission statement dream is “for people to live and work anywhere seamlessly. That means money without borders: moving it instantly, transparently, conveniently, and — eventually — for free.”

The front-stage touchpoints are slick and the app mostly works well (though I find the re-branding terribly ugly). But behind the scenes the backstage systems, processes, staffing and training appear chaotic at best and woefully under-resourced at worst. It’s a classic scale-up failure to focus all resources on new features and growth without growing the support functions and training at the same rate. Automation can help, but it frequently causes more pain, not less.

One job – trust

The mark of a quality service is not how great it is when it works. They should all “just work.” That’s the baseline of any service. We should not be amazed that a money transfer service transfers money.

Wise a great service, until it isn’t. At that point it morphs into the exact opposite of instant, transparent and convenient.

If it were a physical product like a jacket, we would not be impressed by it simply being a jacket. (“It’s amazing, both my arms fit in these tubes called sleeves!”) As soon as the stitching unravelled and the buttons fell off, we would no longer consider it fit for purpose. The jacket is the sum of its parts and a jacket with terrible stitching isn’t a great jacket product with terrible support. It’s just a terrible jacket and we would return immediately it for a refund.

The quality of a service is the sum of its parts and the quality is most starkly revealed when things go wrong and how good the recovery response is. The emotional vector from disgruntled to satisfied again is far greater than any ill-conceived “Wow! moment” when all customers want is the service to just work.

Apart from, you know, actually transferring money, Wise’s main task is to build trust. Despite the multiple failings of banks over the past 15 years, I know my bank is not going to randomly freeze my account and that there is some accountability there.

When I make a transfer with Wise, my main concern is whether the money is safe. Is it going to arrive? If it doesn’t, what then? I simply don’t trust them any more. I’m also very uncomfortable with the amount of financial documentation they demanded given their shambolic operations. A data breach would not surprise me in the least.

Having built up trust over time, they broke it within the space of a few weeks. Even the final apology with an offer of paltry compensation (which never arrived) comprises admissions of multiple failures accompanied by weak apologies without explanations. Most of the response was essentially “this is in our policy and we can demand what we want” ending in “this is our final response,” which shut down the conversation, highlights the asymmetry of the service relationship. I wanted explanations and a conversation more than compensation.

I have previously been a real evangelist of Wise and fintech companies giving banks, well, a run for their money. Now I treat Wise as a necessarily evil, just like the banks they’re trying to disrupt. If a decent competitor arrived, I have very little loyalty remaining that would prevent me from switching.

A fool is easily parted from his money, but so is a Wise customer, it seems.